Advisory

Whether we or our associated experienced domestic and international portfolio managers managing your assets, or advising you on how to invest them, or whether you are based in the U.S or abroad – our focus is you. The more we know about your life, your family and your personal financial goals, the closer we get to tailoring investment strategies to your unique profile. We develop sophisticated investment architectures on behalf of our clients and hand pick instruments that suit their specific liquidity requirements and expectations. We adhere to a disciplined approach guided directly from our clients desired outcome and quality requirements.

We establish contact with our clients’ attorneys, trustees, tax advisors and custodian banks with the purpose of developing the collaboration necessary to fulfill the objective. In instances we introduce our long-term allies and specialists when its required to bring them to the advising table.

We transform mandates into long term family offices, which allows us to optimize cost structure and operations, minimize risks and measure to secure and grow the family’s capital sustainably. We strive to become our client’s trusted partner.

Portfolio Construction

After a comprehensive assessment of your current situation and requirements, we develop tailored concepts through our analytic process. The analytical process carries simulations of the scenarios that could impact a whole range of investment models, including both liquid and fixed assets.

Based on the resulting, systematically recorded information as well as economic data, forecasts and mood indicators for the financial markets, we develop fundamental strategies with clearly defined time horizons. We further take into account any changes in your personal circumstances and adjust your portfolio on an n ongoing basis. We ensure that the instruments we choose, or money management style is of the highest quality and credit rating criteria.

Transparency in communication and ongoing monitoring on every step of portfolio development or adjustment will keep you balanced and aligned.

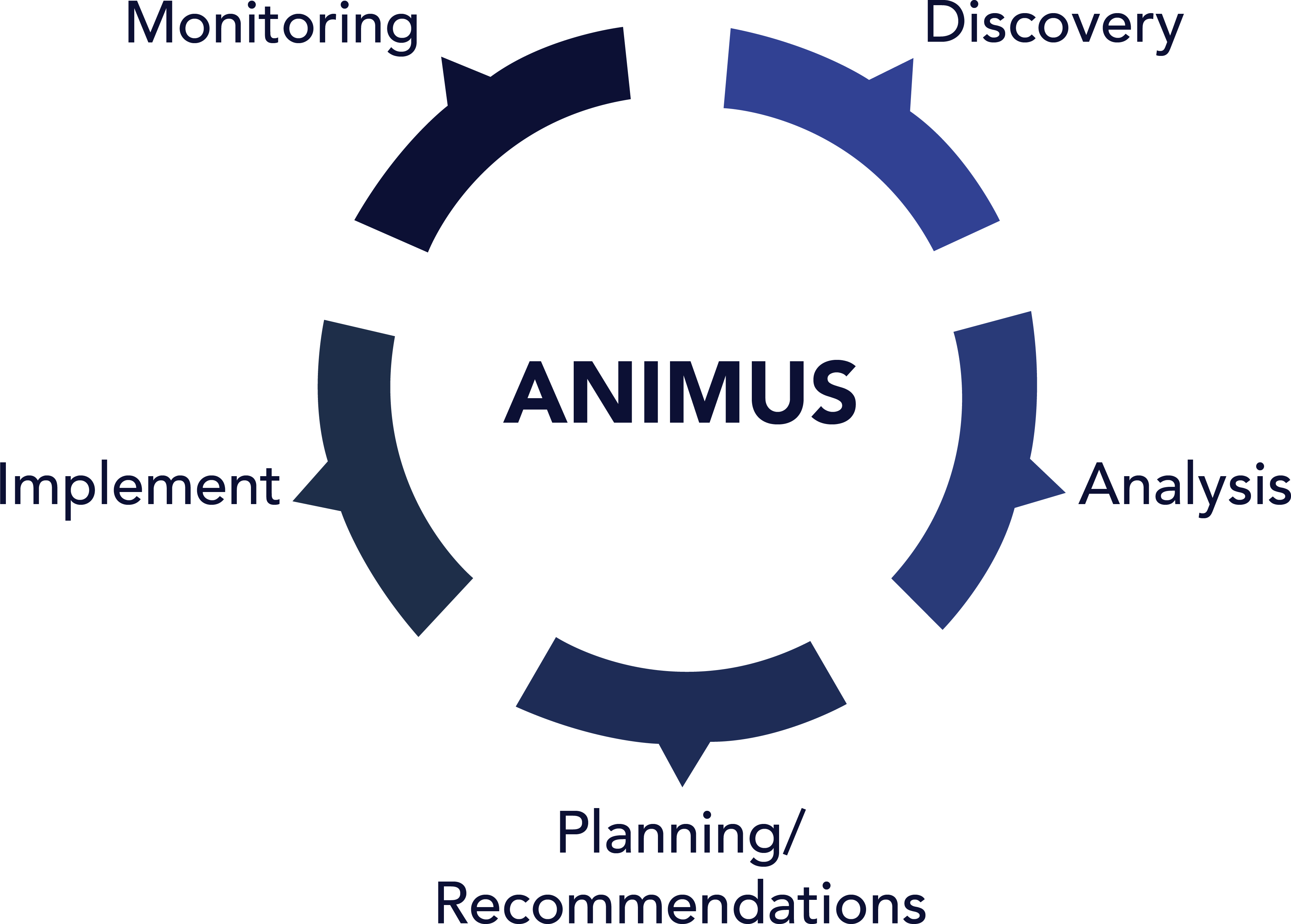

Investment Process

Wealth Management, investment advisory, asset consolidation for private clients is the heartbeat of our business. We ensure our complete focus and expertise on generating the highest possible returns on your assets you entrust to us. Our investment and control system is geared toward responding immediately to market events and change.

Financial & Estate Planning

Our Integrated Financial Planning Process

We provide highly personalized counsel and an integrated suite of financial management services so that our clients can maintain their lifestyles, nurture the next generation, and create a legacy

Relevant solutions to every phase in our client’s financial journey

Our comprehensive financial planning process is aligned with the process promulgated by the Certified Financial Planning Board of Standards, Inc. The steps include:

Establish Our Relationship

Here, we explain our services and define each other’s responsibilities. We discuss our relationship and expectations going forward.

Gather Data and Develop Your Financial Goals

In this step, we gather any necessary documents and discuss your current situation. Together, we define and crystalize your personal and financial objectives, concerns, and opportunities.

Analyze and Evaluate Your Financial Status

Next, Animus will consider all aspects of your situation to determine your potential courses of action necessary to meet your goals.

Review the Recommendations

Animus will go over our recommendations and explain our rationale so you can make informed decisions. We discuss any concerns and make revisions if necessary.

Set the Course

Once recommendations are accepted, we create a plan on how those recommendations will be carried out. Animus may carry out the recommendations or serve as your coach, coordinating the process with you and other professionals, like attorneys and tax professionals.

Benchmark Your Progress Against the Financial Goals You Establish

As you work toward your goals, we stay in constant communication and monitor your progress so you stay on track. If Animus is in charge, Animus will check in from time to time, reviewing your situation and making necessary adjustments to the recommendations.

To learn from about the CFP Board process, visit www.letsmakeaplan.org